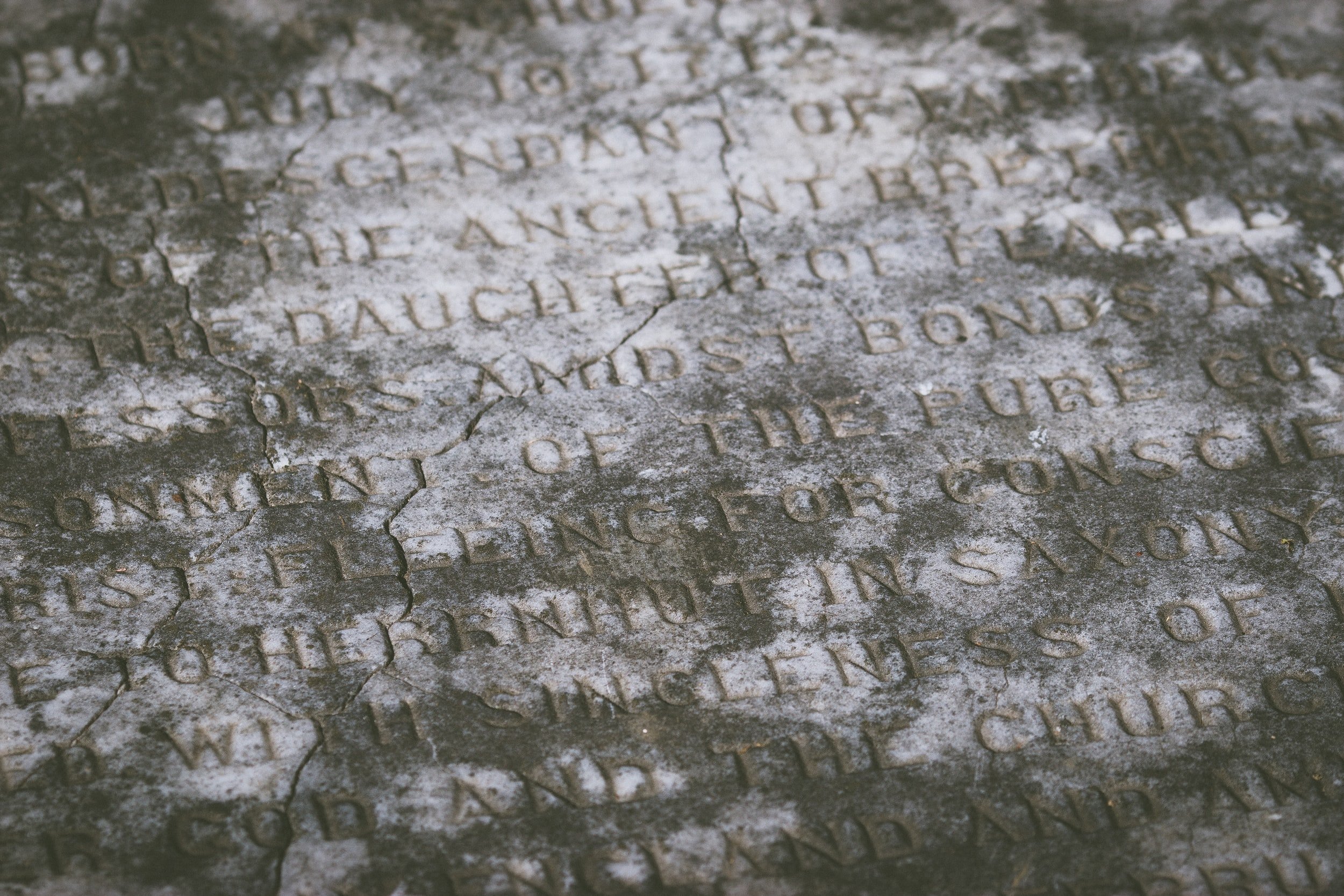

What Will Your Legacy Be?

There are many planned gifts that won’t affect your existing financial resources but will have a significant impact. Give to Temple Sinai while maintaining control and flexibility.

Planned Giving

For over half a century, Temple Sinai has served as a beacon of Reform Judaism, becoming a second home for residents seeking a sense of Jewish life, education, community, and connection that doesn't conform to stricter traditions. Our community thrives on its diverse members - young or old, single or married, Jews by choice or by birth, LGBT and interfaith families, and those who cherish tradition or seek a more unconventional, creative approach to Judaism. Jointly, we are leveraging Sinai's outstanding strengths, including sound fiscal management, to shape a vibrant and enduring Reform Jewish community in northern Vermont.

One meaningful way to invest in the next generation and the continuity of the Jewish people is by backing local Jewish communities through planned giving. We invite you to partner with us in this endeavor. In collaboration, we can safeguard the future of progressive Judaism in northern Vermont for l'dor vador - from generation to generation.

NEW LAW:

Federal economic stimulus legislation may affect your giving. Special Tax Incentives for Giving

Other Ways You Can Give

-

Bargain Sale

Obtain instant cash and simultaneously make a meaningful contribution to Temple Sinai by selling us a valuable asset, such as real estate, at a price below its actual market value.

-

Wills | Trusts

A planned donation from your estate is a sought-after giving method that allows you to fulfill your financial objectives, retain control of your resources, and contribute positively to Temple Sinai.

-

The IRA Gift (QCD)

The IRA charitable rollover (also called the Qualified Charitable Distribution, or QCD) is a great way to make a tax-free gift to Congregation of Temple Sinai.

-

Beneficiary Designation

While your will or living trust allows you to distribute any of your assets, the allocation of your retirement plans, life insurance policies, commercial annuities, and several financial accounts is governed by a document known as a beneficiary designation.

-

Retained Life Estates

By donating your primary or secondary residence, or even a farm to Temple Sinai, you can receive an immediate income tax charitable deduction. What's more, you continue to retain the right to reside in your home for the remainder of your life. If you choose to itemize your deductions instead of opting for the standard deduction, this could lead to significant savings on your income taxes.

Talk to Us

Planned Giving: Secure a Lasting Legacy with Temple Sinai

A charitable gift from your estate is a favored method of giving that enables you to achieve your financial goals, maintain control of your assets, and benefit Temple Sinai. As you plan for the future, consider including Temple Sinai in your estate plans, as this philanthropic choice can create a lasting impact on our community for generations to come.

The Benefits of Planned Giving

Planned giving is not only a generous contribution towards the growth and sustainability of Temple Sinai but also a strategic move that brings financial benefits and peace of mind to you and your family. When you consider a planned gift, you:

Secure your legacy: By including Temple Sinai in your estate plans, you demonstrate your ongoing commitment to our community. Your gift serves as a testament to your values and beliefs, inspiring future generations to continue supporting our programs, worship services, and various initiatives.

Enjoy tax benefits: Charitable gifts from your estate may qualify you for estate tax deductions, reducing the overall burden on you and your family. Consult with your financial advisor to understand the specific tax benefits of planned giving.

Maintain flexibility and control: With planned giving, you retain full ownership and control of your assets during your lifetime. By giving through your estate, you have the option to make changes to your plans, ensuring your financial goals and security remain intact.

Choose the Best Option for Your Gift

There are various ways you can make a planned gift to Temple Sinai:

Bequests through your Will or Trust: One simple method of planned giving is to include Temple Sinai as a beneficiary in your will or trust. In this way, you can allocate a specific amount, a percentage of your estate, or even a particular asset to Temple Sinai.

Life Insurance Policies: Naming Temple Sinai as a beneficiary of your life insurance policy is another way to leave a lasting legacy. This allows you to make a significant future gift to Temple Sinai without impacting your current financial stability.

Retirement Accounts: You can also choose to name Temple Sinai as a beneficiary of your retirement account, such as an IRA, 401(k), or other pension plans.

Remember to consult your financial advisor, attorney, or estate planning professional when creating or updating your estate plans to ensure your wishes are appropriately documented and to maximize your tax benefits.

Your thoughtful planning and generosity will help Temple Sinai continue to flourish, providing spiritual, educational, and cultural opportunities for our community long into the future. Thank you for considering a planned gift and securing a legacy that sustains and enriches the lives of everyone who connects with our beloved Temple Sinai.